Competition heats up under the English Channel

By Keith Fender | November 27, 2023Three companies indicate plans to offer service through Channel Tunnel

LONDON — Since the Channel Tunnel connecting Britain and France opened in 1994, a high speed passenger service operated by Eurostar has connected London, Paris and Brussels (extended to Amsterdam in 2018). Although competition on the route has been theoretically possible for decades, none has started — but this may be about to change as no less than three new operators are planning new services.

In October, start-up high speed rail company Evolyn, based in Spain, announced it planned to order new trains from Alstom and start services between London and Paris within three years. The company is backed by one of Spain’s richest family-owned companies, which is directly involved in the new firm; despite this, within days Alstom put out a media statement saying no order had been placed, but admitted it was discussing one.

Evolyn said it was planning to buy the Alstom “Avelia” high speed train model, which includes the new Acela trains the company is building for Amtrak, but the Avelia brand name also includes high speed EMU designs used in Europe. No firm order has yet been announced by Evolyn or Alstom, and it is likely that it will take more than three years to build the equipment and gain approval for use in the Channel Tunnel. Evolyn says the planned investment in the new venture, by a variety of industrial and financial investors in Britain and Europe, will be over $1 billion.

In Mid-November, British media published articles about another new international rail service from London, this time to be operated by Richard Branson’s Virgin Group. Reports, which Virgin has not confirmed, suggest that some senior managers previously at Virgin Trains, which ran franchised services for the British government from 1997 to 2019, are involved in the new venture. Virgin briefly (2018-2020) was a partner for Brightline in Florida, although the fallout from that relationship is still being dealt with by the courts in London [see “Virgin Group wins lawsuit …,” Trains News Wire, Oct. 12, 2023]

Also in November another start-up operator — Heurotrain, based in the Netherlands — announced plans to start services from Amsterdam to both Paris and London. Heuro has officially applied for the timetable slots beginning in December 2027 (16 trains a day on the Amsterdam-Paris route and 15 daily between Amsterdam and London). Heuro is reported to be raising investment funds in both Europe and the USA.

Heuro has launched a website promoting its plans, suggesting it is aiming at high quality services, but so far giving no details on what trains it plans to use or who is building them, if they have actually been ordered. Heuro says in its publicity material that “there’s been a 32% annual increase in online interest for train travel over five years. High-Speed trains are 98% full at peak times. Over half of Europeans prefer train travel under 2 hours as a greener option,” adding, “Introducing High-Speed operators in train monopolies boosts demand by 45%.” This latter statistic is based upon recent experience in both Italy and Spain, where high speed operators compete.

Eurostar – established operator

Eurostar was originally owned by the British, French, and Belgian governments via their state rail companies — although the British shares were sold as part of rail privatization and are now mostly owned by the Canadian pension fund company Caisse de dépôt et placement du Québec and UK investment firm Hermes Infrastructure. French Railways (SNCF) is the biggest shareholder with over 55% and has led the recent merger of the Thalys Paris-Amsterdam/Germany high speed operation into Eurostar; the combined companies are now branded as Eurostar.

Eurostar received no government financial help during the COVID-19 pandemic from countries where it operates, unlike the airlines it competes with. As a result, Eurostar now has considerable debt of around $1 billion, and is currently focusing on operations linking the four capital cities it serves; services from London to the French Alps and Marseille have been dropped for now, as have regional station calls in France and Britain.

Technical challenge

Operation of trains through the Channel Tunnel requires compliance with special operating rules, reflecting it is a tunnel built under the sea (the world’s longest underwater) crossing an international border. The Channel Tunnel is owned by a private corporation, Getlink, based in France; the high speed route in southern England, HS1, is operated under concession by a private infrastructure management firm largely owned by international investors. Both Getlink and HS1 are keen to encourage competition with Eurostar, as it will result in more use for their tracks. However, doing so is not as simple as just buying off-the-shelf trains.

The trains themselves are required to meet many additional safety rules, such as fire suppression systems, and must be capable of being driven from both ends in an emergency (if the train needed to reverse to avoid a problem in front), and to be able to be split in half with one half moving away from the site of an incident evacuating all the passengers in the process. As the only operator to date has been Eurostar, both its original Alstom-made and more modern Siemens-made train fleets meet all these requirements, although designing and testing them took around five years for each fleet.

There are also operational challenges for any operator, and these, rather than equipment technology, may be the real problem for some of the companies planning new services. The fact the trains are all international means immigration and customs checks have to be made in London. Prior to the UK leaving the European Union under Brexit, these were relatively simple for British and European travelers – but since Brexit both the British government and the EU have decided to introduce new (and separate) electronic entry systems. These will involve collecting biometric data (such as photographs and fingerprints) from every traveller, similar to the arrangements at U.S. airports for international travelers, and these are forecast to cut capacity at the main stations used by Eurostar and potential competitors — at exactly the time more operators want to run more services.

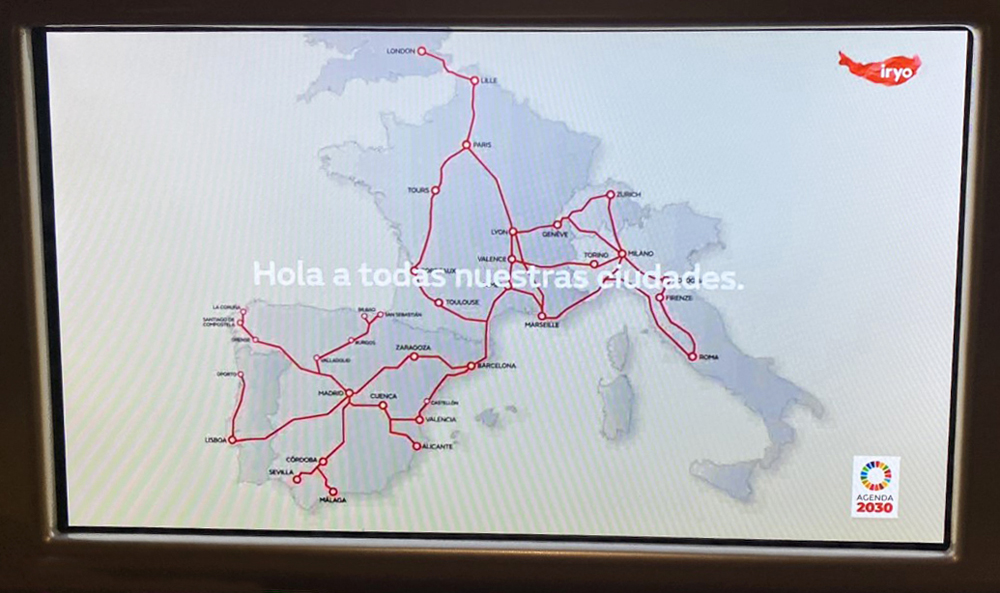

In 2010, Germany national rail company DB announced plans to run London-Brussels-Frankfurt service. Despite having a fleet of potentially suitable trains — it even brought one to London — the service never began. DB senior managers admitted afterwards that project proved not to be viable given the complexity of the Channel Tunnel operating requirements, plus the immigration and security requirements (which were less then, as the UK was still in the EU). However, other European state rail companies remain interested. Spanish national operator RENFE proposed London to Paris services in 2021, but has not since said anything more about them publicly. More recently, Italian state operator Trenitalia — the largest investor in the new “Iryo” open-access, high-speed operator in Spain — includes links from Paris to London on its published future route network.

No comments:

Post a Comment